Achieving daily earnings of ₹3,000 to ₹5,000 is within reach when you build a strong foundation in technical analysis, effective risk management, and consistent trading practices. In this guide, we provide a structured approach to help you embark on this exciting journey in the financial markets.

1. Learn Common Trading Patterns

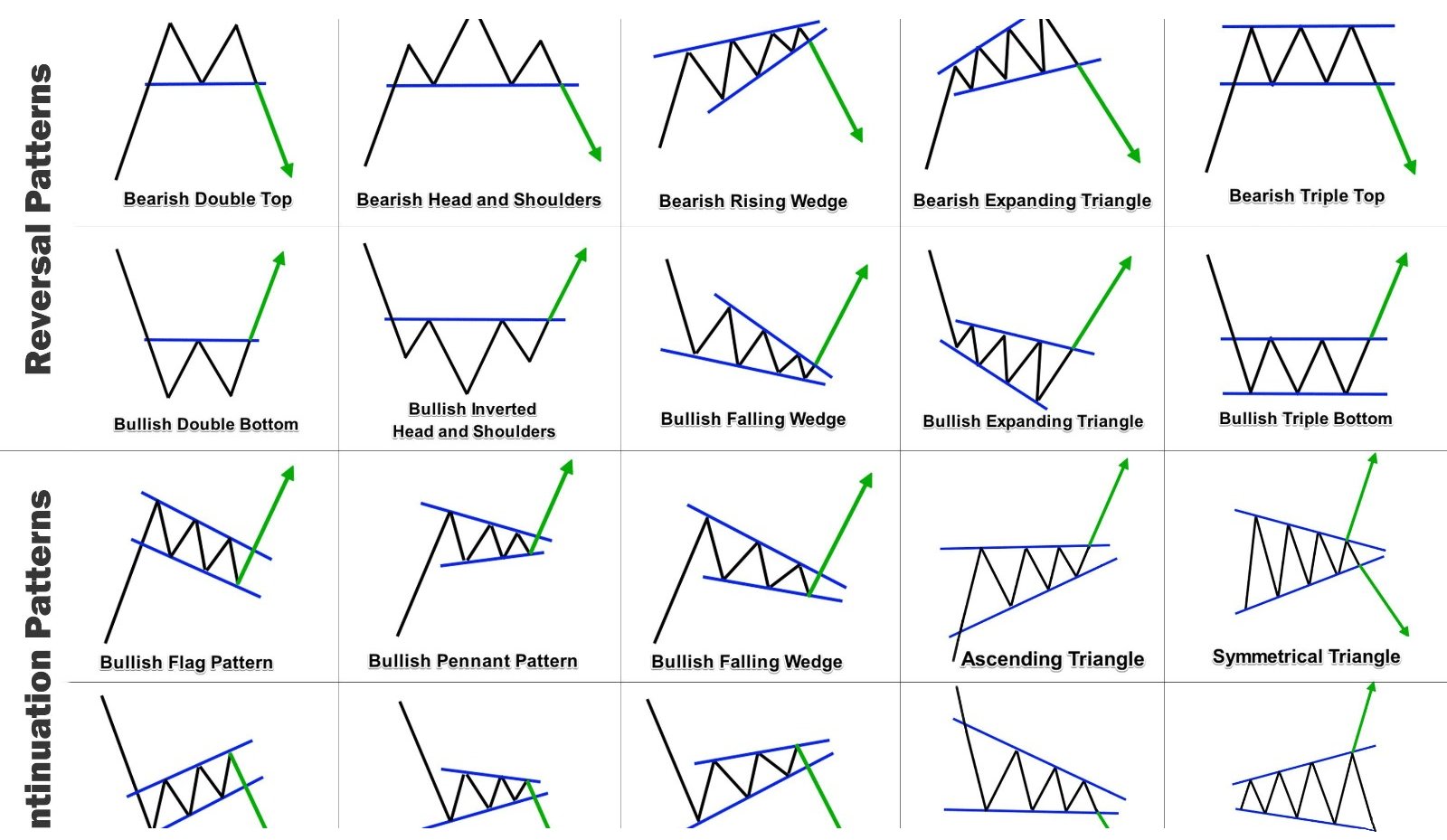

A critical aspect of trading success is mastering key patterns that signal market movements. Here are some essential patterns every trader should know:

-

Candlestick Patterns: Start with understanding crucial candlestick formations like the Doji, Engulfing, and Hammer patterns. These formations often indicate potential price reversals and are vital in identifying market trends.

-

Chart Patterns: Recognize significant chart formations such as Head & Shoulders, Double Tops/Bottoms, and Flags. These patterns can help predict trend changes or continuations.

-

Trendlines and Breakouts: Master trendlines to identify support and resistance levels. Learn how to trade breakouts when prices move beyond these key levels, signaling potential significant price movements.

These patterns are essential topics covered in Capitutor’s Candlestick Chronicles course, designed to equip traders with powerful technical analysis skills.

2. Utilize Time-Tested Strategies

Implementing proven strategies can help you capitalize on market opportunities:

-

Trend Following: Use tools like Moving Averages (MA) and the Relative Strength Index (RSI) to follow strong market trends and enter trades that align with the prevailing direction.

-

Breakout Trading: Look for breakouts from chart patterns like triangles or horizontal ranges and enter trades anticipating that the price will continue moving in the breakout direction.

-

Reversal Patterns: Recognize reversal formations such as Head & Shoulders and Double Tops/Bottoms, which signal potential trend reversals and can give you an edge in the market.

These strategies are thoroughly covered in Capitutor’s Stock Market Bootcamp, which teaches you how to develop and apply time-tested trading strategies.

3. Set Realistic Goals

Focus on achieving consistent gains rather than large, sporadic wins. Aiming for ₹4,000 to ₹5,000 daily through disciplined trading can accumulate substantial profits over time. For example, by targeting just ₹300 per trade and making 10 trades daily, you can reach this goal.

Capitutor’s Options Trade Goldmine will help you refine strategies that prioritize consistent profitability.

4. Implement Effective Risk Management

Risk management is key to long-term success in trading. Here’s how to manage your risk effectively:

-

Position Sizing: Limit your risk to 1-2% of your total trading account per trade. This minimizes losses and protects your capital.

-

Stop-Loss Orders: Use stop-loss orders to limit potential losses on a trade that doesn’t go as expected.

-

Risk-Reward Ratio: Aim for a 1:2 risk-reward ratio, meaning you seek to gain at least twice as much as you risk on each trade. This ensures that the potential reward justifies the risk.

Mastering risk management is a core component of Capitutor’s Forex Wizard, designed for traders who want to thrive in volatile markets.

5. Focus on Liquid Markets

Highly liquid markets such as forex, stocks, and cryptocurrencies offer traders the ability to quickly enter and exit trades without significant slippage. This reduces the risk of missed profit opportunities and ensures more precise execution of trades.

Explore trading in liquid markets with Capitutor’s Crypto Quest, which delves into how to profit from cryptocurrencies and other fast-moving markets.

6. Paper Trade First

Before you risk real money, practice your skills on a demo account. This will allow you to test your pattern recognition and strategies without financial risk. By paper trading, you’ll gain the confidence and competence needed to excel in live markets.

Capitutor’s courses encourage hands-on practice with real-time market data, ensuring you’re well-prepared for live trading environments.

7. Stay Disciplined and Track Performance

Maintaining a trading journal is crucial for tracking your trades, identifying patterns, and assessing performance. By documenting each trade, you’ll learn from both successes and mistakes, continuously refining your approach.

Example: Trading a Simple Pattern

-

Identify the Pattern: Spot a bullish flag on a 1-hour chart, signaling a potential continuation of the upward trend.

-

Entry: Enter the trade when the price breaks out of the flag pattern, confirming the continuation.

-

Stop-Loss: Place a stop-loss just below the flag’s lower boundary to protect against unexpected price movements.

-

Target: Set a profit target based on the height of the flag pattern, maintaining a 1:2 risk-reward ratio.

Conclusion: Unlock Your Trading Potential!

Trading success requires patience, discipline, and continuous learning. Mastering trading patterns, developing proven strategies, and managing risk effectively are the keys to consistent profitability.

Elevate Your Skills with Capitutor!

Ready to transform your trading journey? Enroll in Capitutor’s Technical Analysis Course today. Our expert-led training provides the essential tools and techniques to help you thrive in the world of trading.

Join us now and take your first step toward daily trading success!